In-demand skills in the European Data Centre Market

13 Feb, 20253 mins

March 2025

The European data centre sector is evolving rapidly, driven by advancements in technologies like cloud computing, cybersecurity, and artificial intelligence. However, this growth has exposed significant skills gaps, leaving many organisations struggling to find the talent they need. In this FAQ, we explore the key areas where these gaps exist, why they persist, and how businesses can address the challenge through upskilling, training, and strategic hiring. From changing skills requirements to retention strategies, discover what the future holds for IT talent in the UK and how companies can stay ahead in 2025 and beyond.

Frequently Asked Questions about In-Demand Data Centre Skills

Where are the skills gaps within the UK’s existing IT staff? Which skills are in demand, and why are they lacking?

The skills gaps within the UK’s IT staff are primarily in areas such as cloud computing, cybersecurity, and data analytics. As organisations increasingly rely on cloud services and digital infrastructure, the demand for professionals skilled in these areas has surged. However, due to rapid technological advancements and training programmes not adapting quickly enough to the evolving landscape (yet), there is currently a lack of professionals to meet this demand.

How are skills requirements changing with the advent of new technologies like AI?

With the rise of AI, skills requirements are shifting significantly. There's a growing need for professionals who not only understand AI technologies but can also integrate and manage them within existing systems. Skills in machine learning, data manipulation, and ethical AI development are becoming increasingly critical. Additionally, the ability to work collaboratively with AI systems and harness their capabilities will be essential for future IT roles.

Can existing IT staff fill the gaps – with adequate training?

Yes, absolutely! If IT professionals have a solid foundation of IT principles, this can be built upon through targeted upskilling/training. Organisations that invest in comprehensive training programmes can effectively close skills gaps, leveraging the existing knowledge of their staff while building upon their competencies in new and emerging technologies.

Has there been enough investment in training and qualification programmes in recent years?

Unfortunately, not. Whether this is a result of budgetary restrictions or simply not being able to find trainers skilled to train professionals with the rapidly technological advancements. Some organisations have initiated training initiatives, but many still underinvest in ongoing development. This lack of focus on continuous learning has contributed to the skills gaps we currently face, particularly in fast-evolving fields like data science and cybersecurity.

How can enterprises retain the talent that they do have amidst competitive hiring practices?

To retain talent amidst competitive hiring practices, organisations must foster a culture of growth and development. This includes offering attractive career progression paths, competitive remuneration, and engaging work environments. Additionally, investing in employee well-being and providing ongoing training opportunities can strengthen loyalty and reduce turnover rates. Recognition of contributions and a focus on a supportive workplace culture are also vital in retaining top talent.

What are your expectations for talent, training, and hiring practices in the UK in 2025?

By 2025, I expect to see a more agile approach to training and hiring practices in the UK. Organisations will likely place greater emphasis on continuous learning and adaptability, ensuring that their workforce can keep pace with technological advancements. We may also see a stronger collaboration between industry and educational institutions to align curricula with real-world skills requirements. Employers will increasingly prioritise soft skills, such as problem-solving and teamwork, alongside technical abilities. Overall, a proactive stance will be essential to maintain a robust talent pipeline in a competitive market.

May 2024

The Data Centre market as I predicted at the start of 2024 is witnessing remarkable growth at unprecedented rates, and with the continuous news about new data centres being built such as Microsoft and OpenAI's joint $100 billion (USD) AI Data Centre, the future for the industry is looking very bright.

On a European front, the data centre market is still booming, a recent report by Cushman and Wakefield highlights that cities such Madrid are now challenging the likes of Frankfurt, London, Amsterdam, Paris and Dublin as favourable new locations for data centres. European locations within the mediterranean are starting to become preferred data centre locations spurred on by their proximity to Africa and the Middle East.

Nordic countries also are becoming more popular due to their large renewable energy reserves. Cities such as Stockholm and Oslo are witnessing an increase in data centre builds.

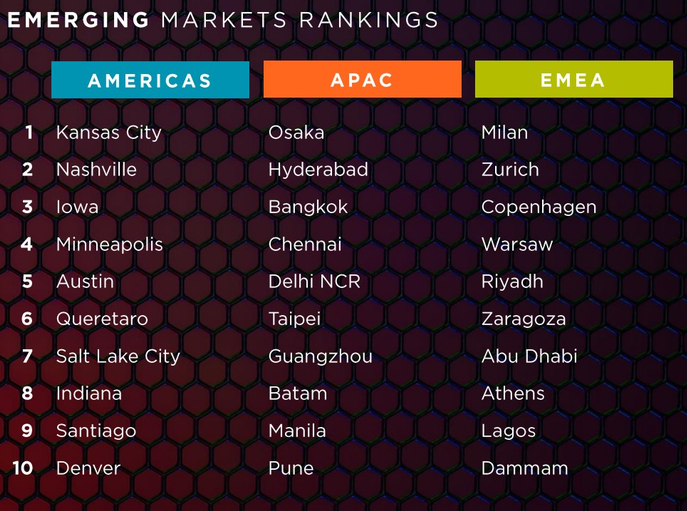

The Cushman and Wakefield report showcases the emerging marketing for preferred data centre build locations - see below.

A recent Data Centre report by ‘Research and Markets’ states "The Europe hyperscaler data centre market is witnessing substantial growth, with a projected value of $39.69 billion by 2028, up from $28.42 billion in 2022, representing a commendable CAGR of 5.72% from 2022 to 2028.“

The UK Data Centre market as reported by yahoo finance "is set to witness a significant growth spurt, going from a value of USD $14.64 billion in 2023 to a projected USD $18.73 billion by 2028. This expansion equates to a Compound Annual Growth Rate (CAGR) of 5.05% over the forecast period from 2023 to 2028."

Here are the top data centre jobs currently being recruited for in Europe:

- Data Centre Engineer

- Data Centre Operator

- Logistics Specialists

- Cloud Engineer

- Planning Manager

One thing's for sure, the European Data Centre market is not slowing down anytime soon. For information about recruiting into data centre's contact Michael Aspinal.

January 2024

The European Data Centre Market: A Hub of Activity and Recruitment Opportunities

The data centre industry in Europe is undergoing significant transformation, driven by the relentless demand for data storage and processing capabilities. As the digital economy expands, so does the need for robust, efficient, and sustainable data centres. The European market, in particular, is witnessing remarkable growth and development, making it a hotbed of activity and recruitment opportunities.

Key Developments in the European Data Centre Market

Recent months have seen several major developments in the European data centre landscape. Notable among them is Blackstone's expansion into data centres through a new venture with Digital Realty Trust as reported by Data Center Knowledge. This collaboration aims to develop four data centre campuses in Frankfurt, Paris, and Virginia, with an estimated investment of around $7 billion. In addition to this, Google recently announced a $1bn investment in the United Kingdom to build its first Data Centre in the country.

As reported by Data Center Knowledge, within Norway, Green Mountain has completed the first of three new data centre buildings for TikTok, marking a significant step in meeting the growing data storage needs in Europe. This 30 MW data centre is part of TikTok’s ‘Project Clover’ initiative and is expected to become Europe’s largest data centre run on renewable energy.

Recruitment within Data Centres

The expansion of data centres across Europe is creating a surge in employment opportunities. Data centres require a wide range of skills, from IT and network specialists to engineers and facility managers. The rapid growth of the sector is leading to a high demand for skilled professionals who can manage the complex and evolving needs of these facilities.

The Data Centre recruitment market is thriving due to the growing demand for skilled professionals in response to the ever-expanding Data Centre sector. The dynamic landscape, influenced by evolving architectures and technologies like cloud computing & AI, underscores the industry's commitment to innovation and resilience.

The real question - is there enough talent globally to meet growth demands? Competition between Data Centre operators to source, onboard and retain good quality candidates is higher than ever.

Market Trends and Projections

According to a report by Savills, the revenue in the data centre market is projected to reach US$85.21 billion in 2024, with network infrastructure dominating the market at a projected volume of US$54.96 billion. The sector is expected to grow at an annual rate of 6.37%, reaching a market volume of US$109.10 billion by 2028. The United States leads in revenue generation, with a forecast of US$99.16 billion in 2024. These figures underscore the burgeoning nature of the data centre industry and its significance in the global digital economy.

The European data centre market is at a pivotal point, with substantial investments and developments reshaping the landscape. This growth is not only fuelling technological advancements but also creating a wealth of employment opportunities in 2024. The future for data centre recruitment looks very interesting, and those within the profession should look forward to the data centre job opportunities that are on the horizon.